Social media and marketing

In today’s digital age, social media is a powerful tool for financial advisors to connect with our target audience, showcase expertise and build a brand presence. Consider investing in paid social media advertising to expand your reach. Targeted ads can help you connect with potential clients who match your ideal client profile.

—Carla Brown, FPFS, CFP, Cuddington, England, UK, seven-year MDRT member

Be genuine

The essence of marketing is that you make the client feel that they are important to your success, that their contribution is priceless. So, give them credit. A little gratitude never hurt anyone. The gratitude that you offer goes a long way, and you become genuine in their eyes.

—Sunil Nandlal Hassija, Ulhasnagar, India, eight-year MDRT member

LIPPS

In line with my commitment, I have created a mnemonic to brief and remind myself before engaging with my prospects and clients.

L — Let the client talk first by asking simple questions about themselves, their background and their life goals.

I — Identify your clients’ concerns during the discussion. This way, I will know their current financial situation and any obstacles they perceive.

P — Present true-to-life stories related to three P’s: problems, people and pera (“money” in Filipino dialect). Through using real-life examples, I can illustrate how similar challenges have been addressed successfully in the past. P — Pause. Let the situation sink in and ask. After sharing stories, it’s essential to give the client time to process the information and reflect on how it relates to their situation. Then ask again what their thoughts are and if they have concerns.

S — Solve your client’s concerns by offering a financial solution. Based on the information gathered and the clients’ expressed concerns, it’s my time to propose a plan to address their needs and goals.

—Beth Daffodil Uy Tan, Taguig City, Philippines, four-year MDRT member

Ensemble practice

Every advisor, regardless of their business model — solo, silo or ensemble — should view themselves as an ensemble practice. The way you do this is to identify subject-matter experts (SMEs) you can turn to for help in providing your clients with services they need, such as retirement planning, tax strategy, investment management and estate planning. You can create streamlined processes with each of the SMEs and create a client experience that feels specific for each individual. Promote these offerings to clients as part of your overall service model, and you will have built a business that will maximize its value in today’s marketplace.

—Peter Hill, ChFC, Des Moines, Iowa, USA, 28-year MDRT member

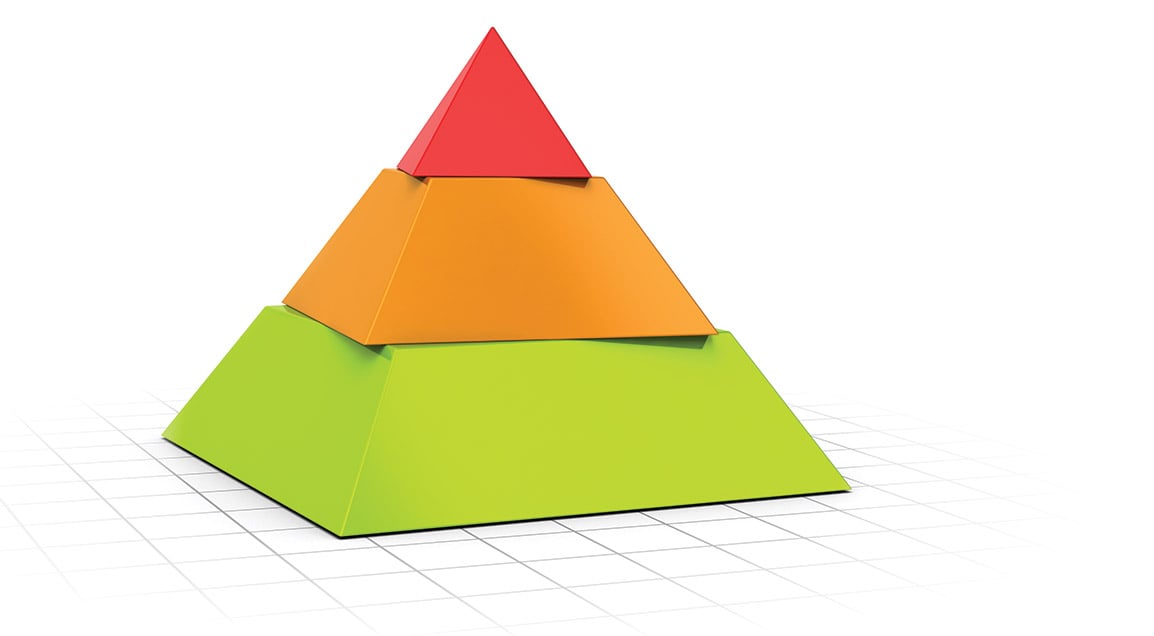

Financial pyramid

When I meet with younger clients, I draw a pyramid on my yellow sheet of paper (I know, I am old school) and explain, “This is your financial pyramid.” I then break the pyramid into three sections:

- The base, which I label “Risk of catastrophic event” (death, disability or extended care event)

- The middle section, which I label “Short-term savings, long-term investing and debt repayment”

- And the top section, which I label “college savings”

Then I go back to the base of the pyramid and explain “You need to set the foundation of your pyramid. You can have a great investment plan, no debt, an emergency fund set up and a college funding plan in place for your children, but if a spouse dies prematurely or becomes disabled, the plan is in ruins. Your greatest asset to your family is your ability to generate income. What if that ended today? Let’s get the foundation set today, and then we can discuss the other sections of the pyramid.”

—Joseph Spinelli III, CLU, LUTCF, Tallahassee, Florida, USA, 14-year MDRT member

Hunter vs. farmer

I think the biggest mistake I see a lot of business owners make when they bring in other advisors is they’re only looking for a hunter. A hunter is someone who gets their energy from going out and bringing in new clients. The business owner thinks, I’m going to hire this person, they’re going to pay for themselves, and I’m going to make a profit off the business they do. In reality, you may need to hire a farmer because you’re already such a good rainmaker and hunter. A farmer is more about nurturing existing relationships and fostering those relationships to earn more business. You can segment a book of your business to a farmer and have the farmer sit in on your client appointments as your second chair to free up your time as the rainmaker.

—Jason L. Smith, Westlake, Ohio, USA, 19-year MDRT member

Be natural

A video for social media that sounds like you and looks like you is much more effective than one that is produced for you and looks and sounds like someone else. You must be genuine and authentic to be believed. You may be tempted to have someone else write them for you, but make sure they are in your voice. Everyone has a style, and to be compelling, videos need to be in your words, your style and your voice. It’s not good or bad; it’s just natural, and natural sells.

—Jim Ruta, coach and business development strategies expert for financial services advisors

Sell yourself first

Before I present to a client, I look at the concept and explain it to myself. What are we doing? How much does it cost? How does it work? How does it not work? How does it fit into the overall plan? And why do I think that this solution is the right one for the client? If I can’t explain it to myself in less than one page, I go back to the drawing board and resell myself on the idea.

—Elke Rubach, LLM., CLU, Toronto, Ontario, Canada, seven-year MDRT member

Clarity of purpose

Achieving success in any facet of life requires a crystal-clear understanding of your purpose. This involves a deep connection with your intrinsic motivation, often referred to as your “big why.” Through my journey, I have uncovered four key elements that contribute to achieving clarity of purpose:

Vision — A clear and compelling vision of your desired future empowers you to steer your life and business toward meaningful goals. A well-defined vision provides direction in the midst of uncertainty.

Values — Core values are crucial in guiding your decision-making process. They act as the compass that ensures your choices align with your fundamental beliefs, promoting authenticity and integrity in your actions.

Goals — Concrete and achievable goals are the road map to realizing your vision. These goals break down your vision into manageable steps, making your aspirations tangible and attainable.

Master the inner voice — Cultivate a positive and supportive inner dialogue. Transform your self-talk into your most enthusiastic supporter. A nurturing inner voice can be a powerful tool in overcoming self-doubt and staying motivated during challenging times.

—Mark Bryant, terminal cancer survivor, Ironman competitor, speaker, author and podcast host

Warm-up stage

Before I think of selling new services or products to clients, I ask them other questions in a warm-up stage. The warm-up includes asking what is going on with them in terms of life milestones, and emotional, physical and financial health. This may take up 50% to 60% of the conversation. The business part is asking what their new goals are, what keeps them awake at night and what their action items are. Only then do I update them about their accounts, a market outlook and what is relevant to their portfolio.

—Arlyn Tiong Tan, MBA, FChFP, Manila, Philippines, 18-year MDRT member

Bonding through service

Shared values are the glue that binds relationships. Volunteering alongside individuals at reputable charitable service organizations who share your unwavering commitment to service creates a natural, authentic bond. These like-minded professionals aren’t just colleagues; they are potential partners in your mission to safeguard the financial futures of those you serve. Imagine the impact of collaborating with a fellow volunteer who runs a thriving small business. Your mutual dedication to service not only strengthens your professional relationship but also positions you as the go-to resource for insurance advice when their business associates, employees or even family members seek trusted guidance. It’s not just about networking; it’s about creating lasting partnerships that benefit both parties.

—Neha Prasad Doiphode, MBA, Navi Mumbai, India, 13-year MDRT member

Branding without financial specifics

The content I create cannot be directly related to insurance or investments, so I don’t use my social media as a marketing platform for the solutions I provide. Instead, I create content that contains my personal touch on topics such as mindset, leadership, productivity and general financial concepts. The idea was that I wanted to create a digital asset library I can use for positioning and branding purposes, showing the world who I am and what I stand for. I prefer talking about these personal subjects because they give me a stronger chance to actively engage and attract like-minded people into my circle.

—Max Thng, CFP, MFA, Singapore, four-year MDRT member