Right around the time Darren Patrick Ryan, CFP, CLU, received results from the 2022 MDRT Benchmarking Survey, his executive assistant submitted her resignation. She was leaving the practice run by the five-year MDRT member from St. John’s, Newfoundland, Canada, and several family members (including Ryan’s dad, 31-year MDRT member Frank P. Ryan, CLU, and Ryan’s brother, four-year MDRT member Francis J. Ryan, MBA, CEBS), for a federal government job that would provide not just a higher salary but a massive increase in time off as well.

That experience — coupled with findings from the confidential survey of 283 Top of the Table and Court of the Table members from the United States, Canada, the United Kingdom, Australia and New Zealand — motivated Ryan not to wait until New Year’s Day to give raises to the five-person staff. Instead, they started reviewing salaries of all staff immediately and began issuing raises a month early on December 1, which were higher than ever before.

“One of the things that stuck out to me the most from the survey was that when you pay higher than average, you get higher than average performance,” said Ryan, whose practice handles employee benefits for more than 150 group insurance and pension clients, as well as comprehensive financial planning for 800 households. “It’s somewhat intuitive, but I realized that what is not seemingly a monumental increase in pay is well worth it to retain the right employee. The survey showed that we need to invest more in current staff, not necessarily just more staff.”

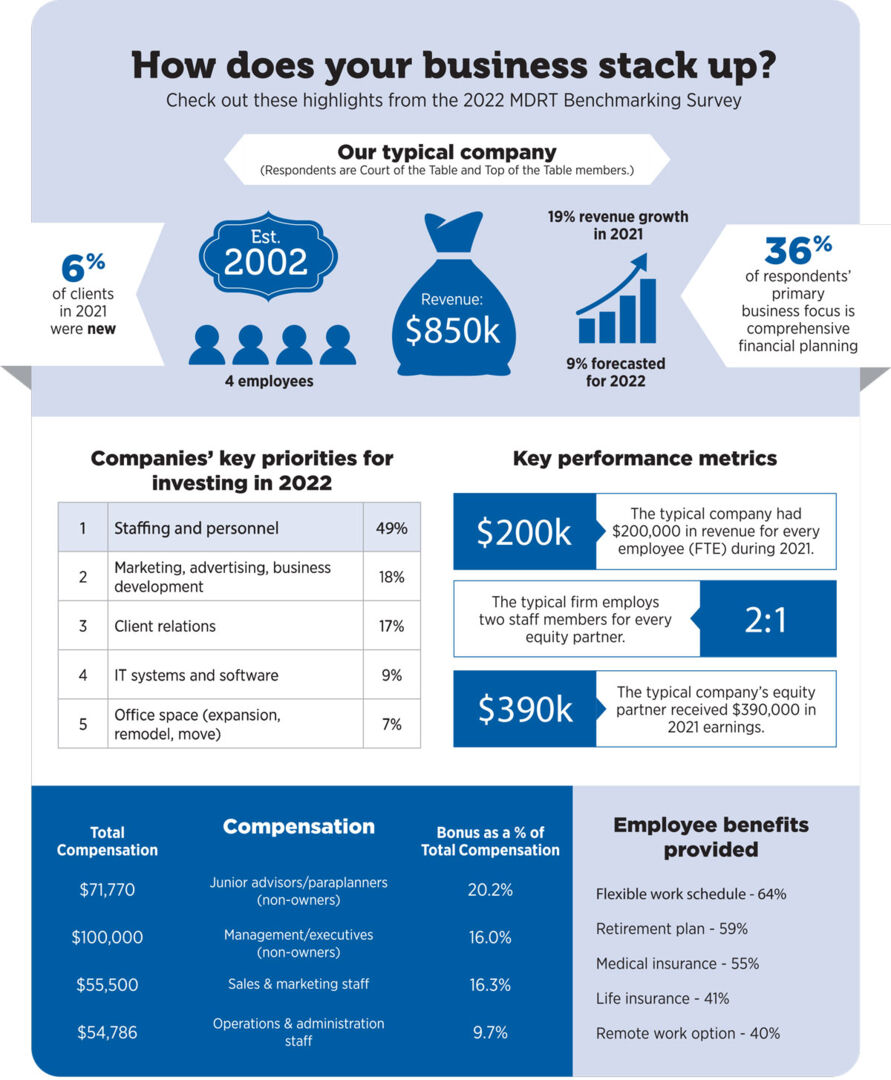

In fact, the survey identified that companies’ top priority for investing in 2022 by a large margin was staffing (49%), followed in a distant second by marketing, advertising and business development (18%). By examining characteristics of top practices — including business profitability, partner compensation levels, staffing, benefits, business continuity plans and much more — the survey helps members compare their own business and identify what areas are strong and where work can be done to improve.

For Jeremy Mark Wellington, Dip PFS, Dip CII, that came down to efficiency. The 12-year MDRT member from Truro, England, UK, scored low in terms of profitability and realized there were several ways he could tighten his practice, which handles financial planning for 143 families and also includes one admin staff member, one trainee advisor (brought on in response to the findings of the 2021 benchmarking survey), and a director of strategic development. These changes included:

- Investing in technology to match the CRM system with recent client growth and regulation. As a result, Wellington’s office is now paper-free, using iPads and Dropbox to not only avoid printing 200 sheets per meeting but also whittle down meeting preparation to 15-30 minutes from an hour or two.

- Increasing connections with younger generations of clients’ families. For example, Wellington has started talking to the children of a client in her late 80s about inheritance tax planning and estate planning and has seen a stronger relationship with the entire family thanks to including more people in the planning process. This speaks to succession planning, the future stability of the practice and efficiency/profitability thanks to retaining current clients and developing new ones.

- Refining the practice’s previously bespoke investment proposition into a more efficient system that can include everyone on the same level of service while reducing overhead and increasing profit.

- Dedicating more time to exploring opportunities via LinkedIn to improve client acquisition strategy, particularly as it relates to younger clients and disability insurance.

- Changing the long, all-staff Monday meeting to a smaller Friday meeting to get out ahead of the following week’s priorities and maximize the time that everyone has to do their work instead of talking about it. “We’re getting far more done and more efficiently, and that came from benchmarking,” Wellington said. “We don’t want existing clients to get less service, and by focusing on efficiency of service, we can offer our existing level of service to more people.”

Speaking of more people: Ryan has also utilized the survey’s information about compensation for hiring, not just retention. Finding the right entry-level candidates has been a challenge for Ryan, who recognizes that he is also competing with banks, engineering firms and accounting firms for these employees. By utilizing the survey’s information about how much top-performing financial services practices are paying their staff, Ryan increased the salary in a job posting for someone who could handle data entry, reception and more.

He discovered that the difference significantly changed the applicant pool, resulting in people with experience instead of just anyone looking for a job.

“Even a few thousand a year is not going to break our business,” he said, “but it helped us find much better candidates. And seeing on the survey that staffing and personnel was the key priority gave me comfort that we’re not alone.”