“Am I spending too much on marketing?” Robert Cullen, FSCP, MBA, wondered. “Am I spending too little?” After more than a decade in the financial services profession, the now-13-year MDRT member from King City, California, USA, still felt like he was in a silo — unaware of what his competitors, or his friends, were doing in their practices.

That is, until he completed the MDRT Business Performance Analysis. The report, formerly known as the Benchmarking Survey and consisting of input from Top of the Table and Court of the Table members, showed him a lot about other businesses and validated that his marketing expenses were in line with what others were doing.

“I can put in a bunch of data, the system crunches the numbers, and it gives me a report showing how I compare to other people in my industry,” Cullen said. “I thought, This is awesome.”

That was four years ago. Since then, Cullen has benefited greatly from Business Performance Analysis insights for staffing decisions and tracking his own progress year to year. Before getting into that, though, let’s review the 2024 report itself:

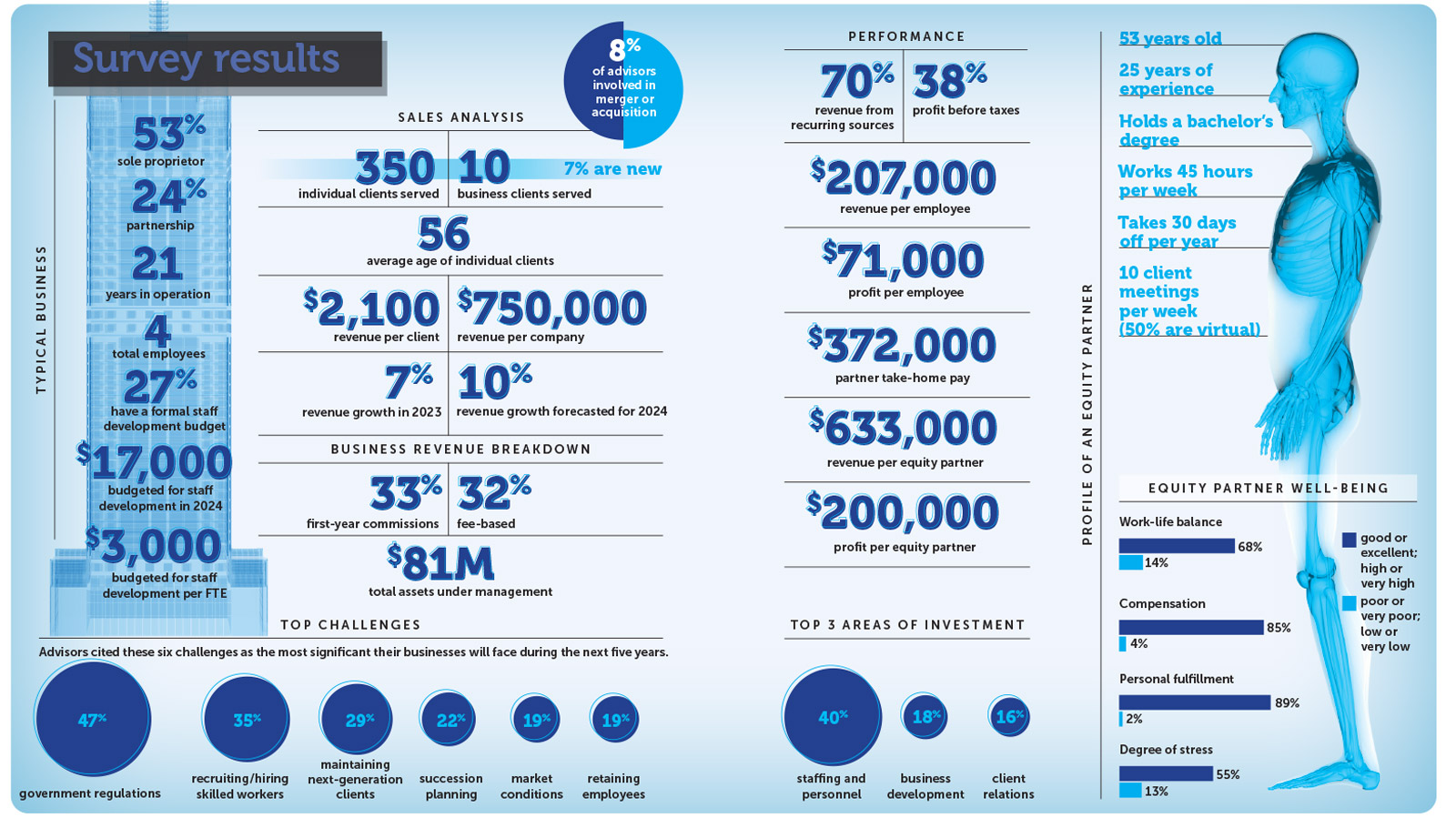

- 246 Top of the Table and Court of the Table members completed the confidential survey, sharing their own sales performance, profitability, compensation levels, staffing and information about their practice’s equity partners.

- They also identified their top three areas for investment and top challenges (see infographic).

- Populated during early 2024, the report contains data from participating members’ businesses in 2023.

The case for expansion

Focusing on the quantitative is nothing new for Aaron Kane, B Bus, AFA, a self-described “big data guy” who loves numbers. Like many advisors, though, the 11-year MDRT member from Wheelers Hill, Victoria, Australia, has been struggling with staffing issues (second on the list of survey participants’ top challenges). By identifying how much advisors spend on admin help, the admin-to-advisor ratio, and the mix of onshore and offshore employees, the analysis helped him better understand what comparable firms are doing. He knew he needed to make a change.

So, Kane, who helps 200 clients with financial planning and retirement, added four staff members in 2024 to what is now a team of 13. The driving factor? Seeing that he was light on admin support compared to other practices. All four new hires work to support the team and have already paid for themselves by helping the office deliver services to clients faster and onboard clients more quickly.

“I made the call six months before we were financially capable of adding people, but I knew that if we got the right team members to release pressure from people, new clients and money would flow from there,” Kane said.

Cullen also wanted to add staff in 2024, as previous reports showed that he was operating with less help compared with similar practices. In tracking his revenue growth and revenue per full-time employee, Cullen determined that the time had come to hire a full-time customer service rep.

“Because I saw other top-performing practices that completed the survey had more staffing, I thought, Let me see what happens if I add someone,” said Cullen, adding that he felt relief seeing that others also struggled with hiring, something he felt was difficult in a small town. “Luckily, it did have a positive impact.”

Like for Kane, Cullen’s business growth exceeded the cost of the employee faster than expected thanks to offloading phone calls and external marketing efforts to the new staff member. Furthermore, Cullen saw Whole Person benefits, as his stress level decreased with less on his plate and more focus on value-added activities.

The more years I do the survey, the more valuable it is to see how I’m improving.

—Robert Cullen

Cost analysis

Kane also sought additional improvements with guidance from the report. For instance, there’s a strong possibility that a raise is in order after Kane saw what equity partners earn compared with what they bring in and realized he was paying himself well below market. He also was spending far below other firms on technology, so he started using an AI note recorder for client meetings. What used to be a 30- to 45-minute process to convert meeting minutes into file notes is now gathered from a transcript by ChatGPT in less than two minutes and finalized by a staff member in less than 10. Doing this up to 10 times per week, depending on the meeting schedule, led to massive time savings and efficiencies that Kane expects will be reflected in the 2025 report.

“I think the best part of the survey is not the data you get at the end but the inputs, the process of completing the survey, because it helps you compare your results from previous years and see how far you’ve come,” Kane said.

More staffing also is helping him focus on opportunities to do more marketing. In addition to what he spends outsourcing evergreen posts, he’s making TikTok videos. Thanks to more time being available by adding staff and being more efficient, Kane schedules every Thursday morning to record videos for the week. Sometimes the content will detail client strategies or scenarios, what he’s done with existing clients, or financial education about how tax and government policy issues in Australia impact retirement. He estimates the videos have generated $100,000 in revenue from eight new preretirement clients.

By extension, the survey results identified that he should look further into mergers and acquisitions, something he hasn’t done previously but has seen more businesses doing as a means of growth. Plus, he now sees additional opportunity to prioritize life insurance, as the survey revealed his recurring revenue for insurance is higher than he thought, even though other firms are writing more new business than he is.

The takeaways speak to what Cullen also loves about the survey — the ability to look at the long term and short term while continuing to learn and grow.

“If you asked me the value of my business five years ago, I’d have said, ‘I have zero clue,’” Cullen said. “As a result of the survey and analyzing my revenue per client, the revenue I’m generating as a producer, and more, it gives me a lot more feeling of how my business is valued if I wanted to sell it on the open market. The more years I do the survey, the more valuable it is to see how I’m improving, and the more value I’m going to get in how it displays trends and growth over time.”

For more information about the MDRT Business Performance Analysis, please contact hbooton@mdrt.org.